Growing annuity financial calculator

Like most providers of financial products and services the US. This calculator assumes a constant return rate with your account growing like compound interest and then paying out like an annuity.

Growing Annuity Formula With Calculator Nerd Counter

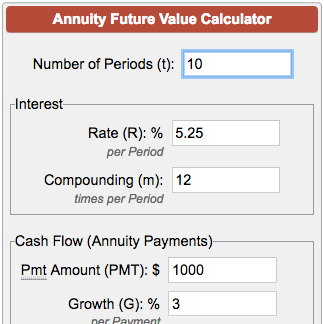

Period commonly a period will be a year but it can be any time interval you want as long as all inputs are consistent.

. After that you need to find out the vanguard funds that are quite identical to other fund families. A fixed deferred annuity also provides you with access to your money. However withdrawals taken during the surrender charge period are generally subject to surrender charges.

An annuity is a financial instrument issued and backed by an insurance company that provides guaranteed monthly income payments for the life of the contract regardless of market conditions. Number of Periods t number of periods or years Perpetuity for a perpetual annuity t approaches. The interest is determined by the premium amount the annuitys term and income withdrawn.

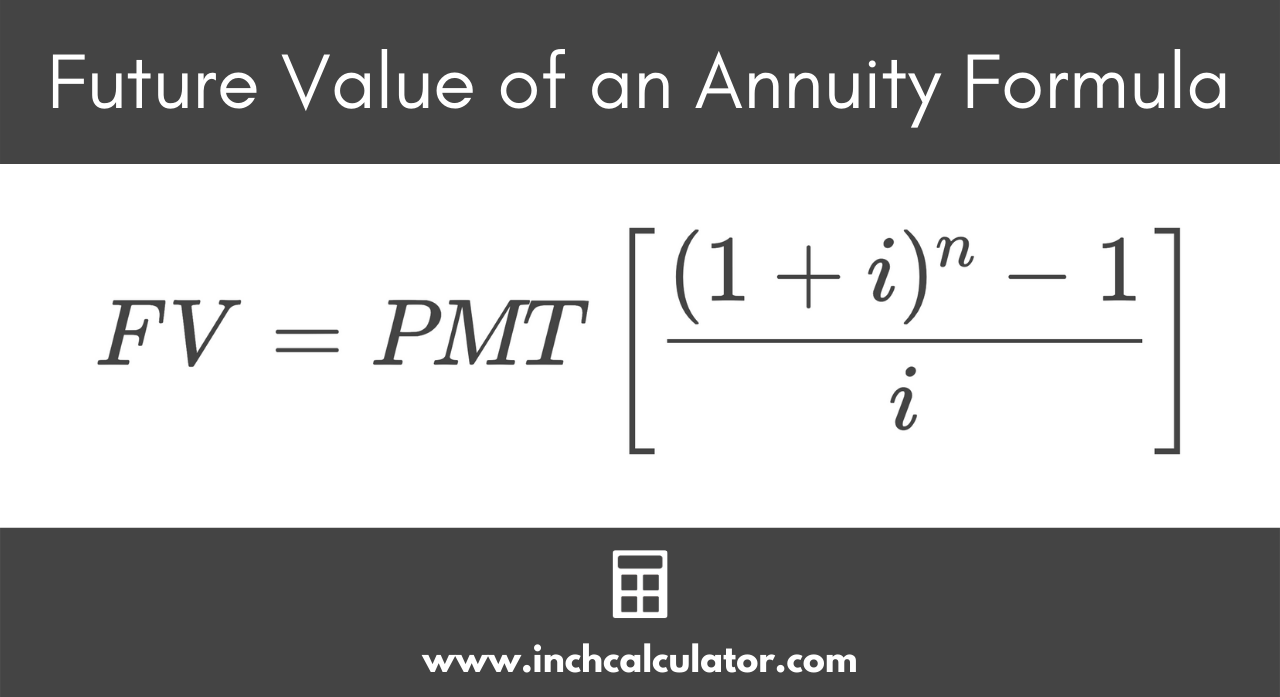

The rate does not change 2. The future value of an annuity formula assumes that 1. If the payment increases at a specific rate the present value of a growing annuity formula would be used.

You should consider the lottery annuity calculator as a model for financial approximation. 5 Financial Planning Mistakes That Cost You Big-Time and what to do instead Explained in 5 Free Video Lessons. This dca calculator stock strengths your financial strategy.

For these reasons this retirement withdrawal calculator models a simple amortization of retirement assets. This estimate does not constitute a binding agreement between you. The first payment is one period.

Use this calculator to find the future value of annuities due ordinary regular annuities and growing annuities. Dollar-cost averaging calculator vanguard. Interest earned in your annuity compounds tax-free until you begin making withdrawals which means your value can grow at a far faster rate.

One can also determine the amount of savings that can be worth investing in and the time period it might last. Make your retirement plan solid with tips advice and tools on individual retirement accounts 401k plans and more. Future Value of Annuity FVA Calculator.

A deferred annuity is an insurance contract that generates income for retirement. An investment calculator helps an individual to determine the approximate period of hisher investment savings. You can easily use this by adding your total assets.

2 Growth Rate For the first zero growth perpetuity the 100 annual payment amount remains fixed whereas the payment for the second perpetuity grows at 2 per year perpetually. For the growing annuity the payment is expected to grow at a constant rate for a finite number of periods. Future Value of Annuity Continuous Compounding FVACC Calculator.

Most companies will allow you to withdraw a portion of your deferred annuitys account value usually 10 each year without a company-imposed surrender charge. Alternatively youll reach your goal in after-inflation terms todays dollars in 2055. Due to the technological advancement TVM formulas are built in the financial calculator and students can utilize its function keys to work TVM calculations efficiently.

How to Estimate the Expected Return of a Stock Investment. Fixed Deferred Annuity Calculator. Of periods the interest is compounded either ordinary or due annuity.

No single retirement withdrawal calculator can model all spending alternatives effectively. The future value of an annuity formula is used to calculate what the value at a future date would be for a series of periodic payments. Note 1 Guarantees apply to certain insurance and annuity products and are subject to product terms exclusions and limitations and the insurers claims-paying ability and financial strength.

Since lottery annuities typically follow a growing annuity structure where the amount of yearly payout grows by a given rate the lottery annuity may take the following form. In exchange for one-time or recurring deposits held for at least a year an annuity company provides incremental. This future value of annuity calculator estimates the value FV of a series of fixed future annuity payments at a specific interest rate and for a no.

Use a calculator to compute the interest you will save if you make extra payments. Calculate the present value of an annuity due ordinary annuity growing annuities and annuities in perpetuity with optional compounding and payment frequency. Say for example that your extra payment reduces your principal from 10000 to 9900.

Future Value Growing Annuity FVGA Payment Calculator. Although financial calculators help students compute answers. Treasury is working hard to modernize its programs and make them more attractive to the growing number of individuals who prefer electronic investments they can manage themselves online with 24-hour access.

There is more info on this topic below the form. So whether one has started investing or whether they have been investing for some time an investment calculator can. P n -PV 1 -.

All payment figures balances and tax figures are. An annuity is a long-term insurance contract sold by an insurance company designed to provide an income usually after retirement that cannot be outlived. Use this annuity tax calculator to compare the tax advantages of saving in an annuity versus a taxable account.

Use the 10000 figure and calculate your amortization over the remaining term of the loan. Using our compound interest calculator 20000000 invested in a fixed deferred annuity can earn up to 3354800 in interest over five years. The dollar amount from this calculator is an estimate based on user-entered data.

We strongly support the US. Annuity formulas and derivations for present value based on PV PMTi 1. For the zero-growth perpetuity we can calculate the present value PV by simply dividing the cash flow amount by the discount rate resulting in.

See the Risky Retirement Calculator to see how volatility affects retirement income. Try our Intrinsic Value Calculator. Based upon the numbers above you will be a millionaire in 30 yearsIf you start today that means youll reach your goal in before-inflation terms in 2051Your million dollar savings will be worth 741923 in todays dollars inflation adjusted at that time.

Then compare your investments with market values. How the Three Financial Statements Are Linked. If the first payment is not one period away as the 3rd assumption requires the present value of annuity due or present value of deferred annuity may be used.

You can find loan amortization calculators on the Internet.

Growing Annuity Calculator

Excel Formula Payment For Annuity Exceljet

Future Value Of Annuity Calculator

Future Value Of An Annuity Calculator Inch Calculator

Pin On The Calculators

Future Value Of Growing Annuity Formula With Calculator

Growing Annuity Calculations On Texas Instruments Baii Plus Youtube

The Future Value Of An Increasing Annuity Part 2 Youtube

Future Value Annuity Due Tables Double Entry Bookkeeping Time Value Of Money Annuity Table Annuity

Present Value Of A Growing Annuity Calculator Double Entry Bookkeeping Annuity Calculator Annuity Calculator

Present Value Of A Growing Annuity Calculator Double Entry Bookkeeping

Present Value Pv Of An Annuity Due Using Ti Baii Plus Calculator Youtube

Ba Ii Plus Ordinary Annuity Calculations Pv Pmt Fv Youtube

Present Value Of An Ordinary Annuity Financial Calculator Sharp El 738 Youtube

Future Value Of Annuity Calculator

Present Value Of An Annuity How To Calculate Examples

Payments Of Annuities Texas Instruments Ba Ii Plus Youtube